Princeton Ma Property Tax Rate . Data analytics and resources bureau tax rates by class data current as of 08/18/2024 Our fiscal year begins on july 1st and ends the following june. The town of princeton tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. The fiscal year 2024 tax rate has been approved at $14.03. Values are generated based on market conditions. The town of princeton assessoris responsible for appraising real estate and. The role of assessors in municipal finance. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. 37 rows historical tax rates. How to pay a bill in. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments.

from www.caliper.com

The fiscal year 2024 tax rate has been approved at $14.03. How to pay a bill in. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. 37 rows historical tax rates. The town of princeton tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. Our fiscal year begins on july 1st and ends the following june. The role of assessors in municipal finance. Values are generated based on market conditions. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. Data analytics and resources bureau tax rates by class data current as of 08/18/2024

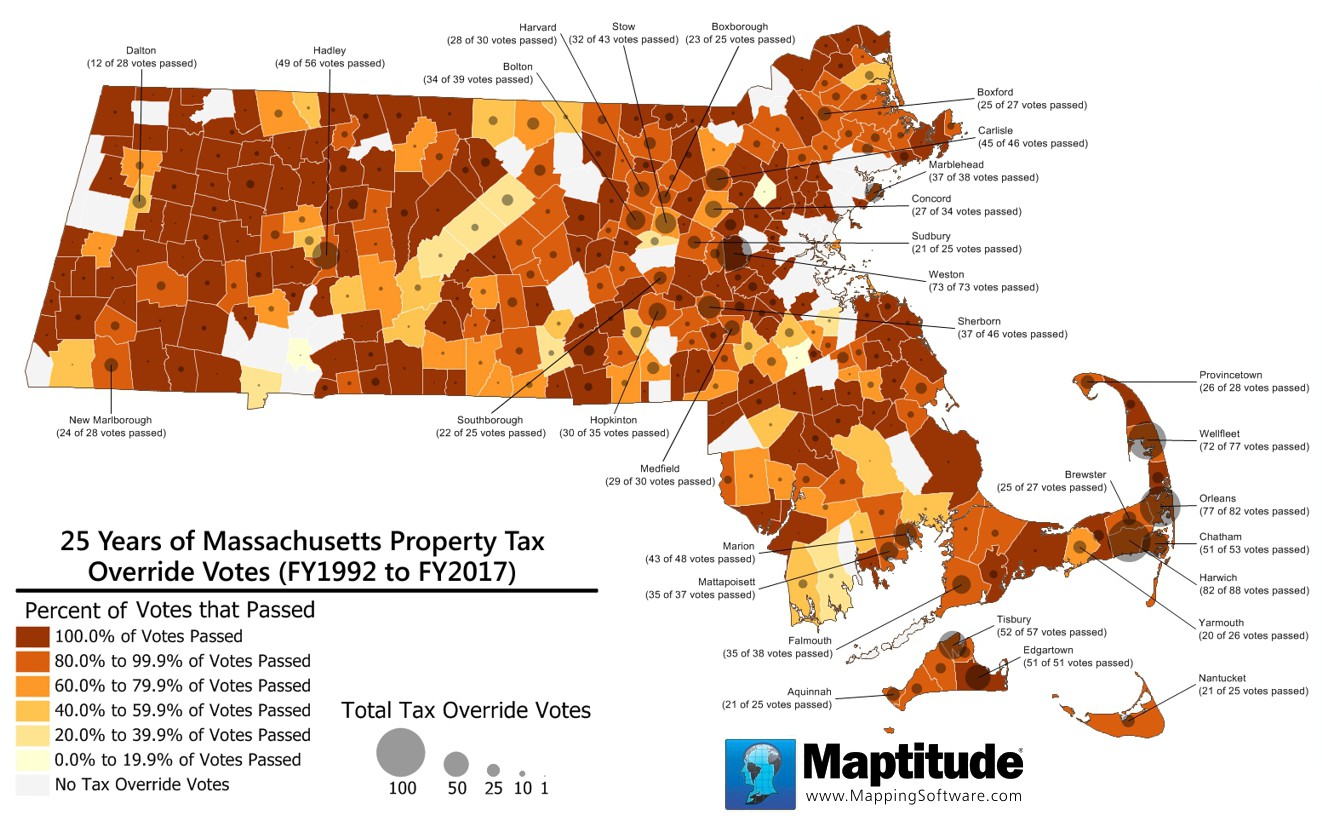

Maptitude Map Massachusetts Property Tax Override Votes

Princeton Ma Property Tax Rate The role of assessors in municipal finance. The role of assessors in municipal finance. Our fiscal year begins on july 1st and ends the following june. How to pay a bill in. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 The fiscal year 2024 tax rate has been approved at $14.03. 37 rows historical tax rates. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. The town of princeton tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. The town of princeton assessoris responsible for appraising real estate and. Values are generated based on market conditions.

From northofbostonlifestyleguide.com

Massachusetts Property Tax Rates NORTH OF BOSTON LIFESTYLE GUIDE™ Princeton Ma Property Tax Rate Data analytics and resources bureau tax rates by class data current as of 08/18/2024 How to pay a bill in. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. Our fiscal year begins on july 1st and ends the following june. Values are generated based on market conditions. 37. Princeton Ma Property Tax Rate.

From masslandlords.net

How Much Are Your Massachusetts Property Taxes? Princeton Ma Property Tax Rate Values are generated based on market conditions. 37 rows historical tax rates. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 The fiscal year 2024 tax rate has been approved at $14.03. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. The town of. Princeton Ma Property Tax Rate.

From northofbostonlifestyleguide.com

Massachusetts Property Tax Rates NORTH OF BOSTON LIFESTYLE GUIDE™ Princeton Ma Property Tax Rate 37 rows historical tax rates. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. The town of princeton assessoris responsible for appraising real estate and. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. Values are generated based on. Princeton Ma Property Tax Rate.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Princeton Ma Property Tax Rate The fiscal year 2024 tax rate has been approved at $14.03. 37 rows historical tax rates. The town of princeton assessoris responsible for appraising real estate and. Values are generated based on market conditions. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. How to pay a bill in. Our. Princeton Ma Property Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Princeton Ma Property Tax Rate The town of princeton assessoris responsible for appraising real estate and. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. 37 rows historical tax rates. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 The fiscal year 2024 tax rate has been approved at $14.03.. Princeton Ma Property Tax Rate.

From www.homeownershiphub.com

Massachusetts Property Tax Rates by County and Town Princeton Ma Property Tax Rate Values are generated based on market conditions. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 37 rows historical tax rates. Our fiscal year begins on july 1st and ends the following june. The town. Princeton Ma Property Tax Rate.

From www.taxuni.com

Massachusetts Property Tax 2023 2024 Princeton Ma Property Tax Rate Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. The town of princeton assessoris responsible for appraising real estate and. How to pay a bill in. 37 rows historical tax rates. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year. Princeton Ma Property Tax Rate.

From www.dochub.com

Massachusetts cities Fill out & sign online DocHub Princeton Ma Property Tax Rate In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. How to pay a bill in. The town of princeton tax assessor can provide you with a copy of your property. Princeton Ma Property Tax Rate.

From prorfety.blogspot.com

PRORFETY Massachusetts Property Tax Rates Map Princeton Ma Property Tax Rate 37 rows historical tax rates. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 The town of princeton assessoris responsible for appraising real estate and. The fiscal year 2024 tax rate has been approved at $14.03. How to pay a bill in. The role of assessors in municipal finance. The town of princeton tax assessor. Princeton Ma Property Tax Rate.

From prorfety.blogspot.com

PRORFETY Massachusetts Property Tax Rates Map Princeton Ma Property Tax Rate The town of princeton assessoris responsible for appraising real estate and. The role of assessors in municipal finance. Our fiscal year begins on july 1st and ends the following june. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 Values are generated based on market conditions. The fiscal year 2024 tax rate has been approved. Princeton Ma Property Tax Rate.

From chesliewgiulia.pages.dev

Massachusetts Town Tax Rates 2024 Dulce Glenine Princeton Ma Property Tax Rate 37 rows historical tax rates. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 The fiscal year 2024 tax rate has been approved at $14.03. The role of assessors in municipal finance. How to pay a bill in. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal. Princeton Ma Property Tax Rate.

From www.attomdata.com

Property Taxes on SingleFamily Homes Rise Across U.S. in 2021 ATTOM Princeton Ma Property Tax Rate Our fiscal year begins on july 1st and ends the following june. The town of princeton assessoris responsible for appraising real estate and. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. 37 rows historical tax rates. How to pay a bill in. The fiscal year 2024 tax rate has. Princeton Ma Property Tax Rate.

From elgaqramona.pages.dev

Massachusetts Estate Tax 2024 Hallie Laurie Princeton Ma Property Tax Rate 37 rows historical tax rates. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 The fiscal year 2024 tax rate has been approved at $14.03. Values are generated based on market conditions. How to pay a bill in. Our fiscal year begins on july 1st and ends the following june. In the commonwealth of massachusetts,. Princeton Ma Property Tax Rate.

From suburbs101.com

Massachusetts Property Tax Rates 2023 (Town by Town List with Princeton Ma Property Tax Rate Data analytics and resources bureau tax rates by class data current as of 08/18/2024 Search our extensive database of free princeton residential property tax records by address, including land & real property tax assessments. Values are generated based on market conditions. The town of princeton tax assessor can provide you with a copy of your property tax assessment, show you. Princeton Ma Property Tax Rate.

From www.boston.com

Townbytown assessed home values and billed property tax amounts in Princeton Ma Property Tax Rate Data analytics and resources bureau tax rates by class data current as of 08/18/2024 Our fiscal year begins on july 1st and ends the following june. The town of princeton tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. How to pay a bill in. Search our. Princeton Ma Property Tax Rate.

From live959.com

10 Towns With The Highest Property Tax Rates In Massachusetts Princeton Ma Property Tax Rate The town of princeton assessoris responsible for appraising real estate and. How to pay a bill in. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 Our fiscal year begins on july 1st and ends the following june. 37 rows historical tax rates. In the commonwealth of massachusetts, all real estate and personal property taxes. Princeton Ma Property Tax Rate.

From www.youtube.com

Massachusetts Property Tax Rates 2022 vs 2023 YouTube Princeton Ma Property Tax Rate The town of princeton tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. Our fiscal year begins on july 1st and ends the following june. Data analytics and resources bureau tax rates by class data current as of 08/18/2024 The role of assessors in municipal finance. Values. Princeton Ma Property Tax Rate.

From prorfety.blogspot.com

PRORFETY Massachusetts Property Tax Rates Map Princeton Ma Property Tax Rate Our fiscal year begins on july 1st and ends the following june. In the commonwealth of massachusetts, all real estate and personal property taxes are assessed on a fiscal year basis. 37 rows historical tax rates. The town of princeton assessoris responsible for appraising real estate and. The fiscal year 2024 tax rate has been approved at $14.03. Search our. Princeton Ma Property Tax Rate.